Financial Tranquility for Doctors: A Step-by-Step Path to Clarity and Calm

Nov 15, 2025

Introduction

Doctors save lives every day.

But when it comes to their own financial health… let’s just say many are still in triage.

A high income is wonderful — until it disappears faster than a box of gloves during flu season.

After years of coaching physicians, I’ve realized one simple truth:

👉 Financial tranquility doesn’t come from earning more; it comes from feeling in control.

And the good news?

Control is learnable.

Here’s your step-by-step recovery plan — no anesthesia required.

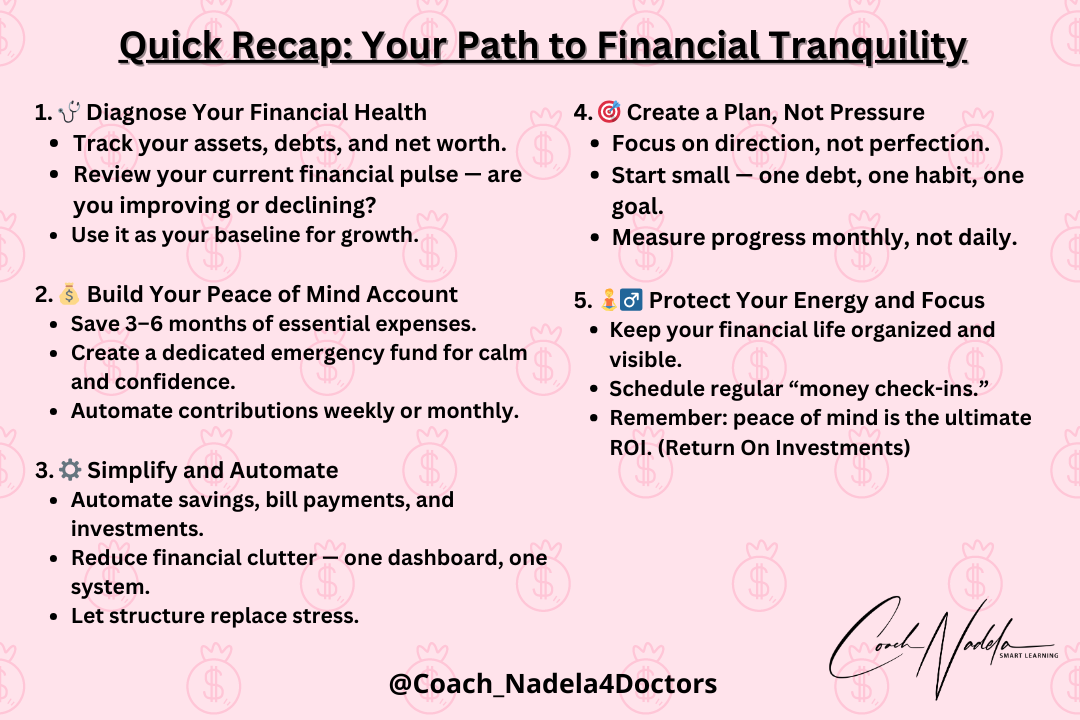

TL;DR

- Why it matters: Financial tranquility isn’t about earning more — it’s about feeling in control and at peace with your money.

- Challenges: Doctors often face decision fatigue, lack of time, and scattered finances that lead to stress and uncertainty.

- What’s inside: A simple, 5-step recovery plan to bring clarity and calm — from tracking your net worth and building your Peace of Mind Account to simplifying, automating, and protecting your focus.

Step 1 — Diagnose Your Financial Health

Before treating any patient, you start with a diagnosis.

The same rule applies to your money.

✅ Track your Net Worth — what you own minus what you owe.

It’s your financial pulse, one number showing whether you’re getting better or worse.

Don’t worry — it’s painless and takes less time than your average consult.

💡 Actionable Tip: Spend 15 minutes calculating your current net worth. Don’t overthink the details — just get your first baseline number.

📖 Related reading: How to Assess and Grow Your Net Worth as a Doctor

Step 2 — Build Your Peace of Mind Account

Every hospital has an emergency department.

Your finances need one too.

Your Peace of Mind Account is your financial oxygen mask — the calm you put on first before helping others.

Aim for 3–6 months of essential expenses.

Once it’s built, even big surprises lose their drama.

It’s like having a defibrillator for your stress.

💡 Actionable Tip: Set up a dedicated savings account labeled Peace of Mind Fund. Automate a small transfer — even €50 a week — starting today.

📖 Related reading: 7 Proven Strategies for Managing Cash Flow as a Doctor

Step 3 — Simplify and Automate

If you’re already juggling patients, calls, and conferences, the last thing you need is a 20-tab spreadsheet.

Tranquility thrives on simplicity.

Automate your savings, debt payments, and investments.

Let the system work while you rest — like your heart, but without the cardiology bill.

💡 Actionable Tip: Choose one financial habit to automate this week — your savings, loan payment, or investment transfer. Simplicity brings peace.

📖 Related reading: 5 Essential Steps to Empower Doctors with a Robust Financial Plan

Step 4 — Create a Plan, Not Pressure

You don’t need to be a financial superhero.

(Although, honestly, a cape would look great with your white coat.)

Financial tranquility is about direction, not perfection.

Start small:

- Build your Peace of Mind Account.

- Pay off one high-interest debt.

- Review your net worth monthly.

Progress, not pressure — that’s the prescription.

📖 Related reading: The Doctor’s Prescription for a Healthy Financial Future

Step 5 — Protect Your Energy and Focus

Decision fatigue is real — and not just for patients.

Keep one dashboard, one place, one clear view of your money.

When everything’s organized, the noise fades and calm returns.

Because the most underrated financial skill isn’t investing.

It’s sleeping well at night.

💡Actionable Tip: Schedule one 30-minute “money check-in” on your calendar each month. Treat it like a medical follow-up for your finances.

Conclusion - Final Thought

Financial tranquility isn’t a luxury — it’s preventive care for your peace of mind.

Just as you tell your patients that prevention beats cure, the same applies to your money.

Building clarity, order, and confidence around your finances is not about chasing wealth — it’s about protecting your energy, time, and mental health.

Because when your finances are under control:

- You make decisions with calm, not pressure.

- You work because you choose to, not because you have to.

- You sleep better, think clearer, and show up stronger — for your patients, your family, and yourself.

So start small.

Track your net worth, build your Peace of Mind Account, and set one simple financial system in motion.

Do it not for the numbers, but for the tranquility that follows — that quiet moment when you finally exhale and realize you’re okay… and in control.

👉 Join the Free “Smart Money for Smart Medics” Course

A few minutes today could save you years of financial stress — and maybe a few grey hairs, too.

Stay healthy, stay wise. 💚

Coach Nadela

Financial Coach for Medics